Trade Volume Economics Definition

Effects of exchange-rate volatility on the volume of international trade have been the subjects of both theoretical and empirical investigations. Patterns of trade evolve over time as countries develop and build new comparative advantage in both goods and services.

/dotdash_INV-final--On-Balance-Volume-OBV-Definition-June-2021-01-16906b2a337a4e59a30a0b7d04a78a8a.jpg)

On Balance Volume Obv Definition

Submitted by Taps Coogan on the 28th of February 2016 to The Sounding Line.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Sideways_Market_Sideways_Drift_Jan_2021-01-ae5a330a3cea4ff2801f1d6ab69eb7b7.jpg)

Trade volume economics definition. Sometimes countries ensure a regular flow of international trade ie a high volume of both imports and exports by entering into a trade agreement with another country. Since a large number of commodities enter in international transaction the volume of trade can be measured only in terms of money value. Trade are as follows.

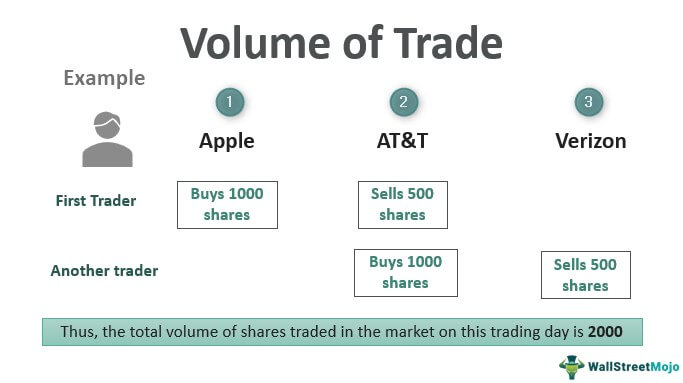

Global Trade Value vs. This metric allows you to see how popular an asset is and how frequently it is changing hands. Volume of trade is the total quantity of shares or contracts traded for a specified security.

In a similar way the robustness of global trade can help us understand. Such agreements are aimed at stimulating trade and supporting economic growth for both countries involved. Trading volume is the amount of activity that is surrounding a coin or a token.

Definitions Data Analysis and Implications of Portfolio Theory. In the context of a single stock trading on a stock exchange the volume is commonly reported as the number of shares that changed hands during a given day. As there is a seller for every buyer one can think of the trading volume as half of the number of shares transacted.

In most countries it represents a significant share of gross domestic product GDP. A decrease in cost per unit of output enables an increase in scale. In The Velocity of Money A Cautionary Tale link here we looked at the velocity of money as an important indication of the health of the US.

Basic terms of trade. Foreign trade is the exchange of capital goods and services across international borders or territories. Its an indication of the interest that investors have in that particular security or product at its current price.

Economic fundamentals such as the inflation rate interest rate and. The composition of a countrys imports and exports and the volume of its trade with the rest of the world is likely to change over a period of time. Export volume indexes are derived from UNCTADs volume index series and are the ratio of the export value indexes to the corresponding unit value indexes.

For example if shares in a security are traded 50 times in a day the volume for the day is 50. A trade-off occurs when we make a choice that benefits us but to acquire that benefit we also have to give up something of value. A high trading volume is an indicatorof a high level of interest in a security at its current price.

In microeconomics economies of scale are the cost advantages that enterprises obtain due to their scale of operation and are typically measured by the amount of output produced. In capital markets volume or trading volume is the amount total number of a security or a given set of securities or an entire market that was traded during a given period of time. Trading volume or volume in trading is the number of completed trades in a single security or across a whole market in a given time period.

But if a number of traders took positions in the security during the day and closed them out by the end of the session the trading volume can. Exchange rate volatility is defined as the risk associated with unexpected movements in the exchange rate. Country A needs to import 200 tons of wheat from Country B 200 import price.

The trends in the value of trade over time help to identify the basic forces that may be operating at different periods in the economy. Let us understand this with an example. According to the WTO from 2011 developing economies exports to other developing economies surpassed its exports to developed economies.

The measure how many tradestake place for a securityor on an exchangeon a given trading day. Dictionary of Financial Terms. It can be measured on any type of.

Pattern of Trade Pattern of Trade. Trading volume The number of shares transacted every day. Country A can export 700 tons of corn to Country B 700 export price.

The price of exports the price of imports x 100. Trading volume is the quantity of stocks bonds futures contracts options or other investments that are bought sold in a specific period of time normally a day. Its a ledger of the buying and selling activity surrounding each coin or token and it can be very useful for planning your trades.

It relates to the size of international transactions. The so-called trade openness index is an economic metric calculated as the ratio of countrys total trade the sum of exports plus imports to the countrys gross domestic product. This can be seen clearly in the case of the UK.

One key change in global trade is the rise in South-South trade. At the basis of economies of scale there may be technical statistical organizational or related factors to the degree of market control. This metric gives us an idea of integration because it captures all incoming and outgoing transactions.

We examine the implications of portfolio theory for the cross-sectional behavior of equity trading volume. The most important changes in UK. Industrialization advanced transportation globalization multinational corporations and outsourcing are all having a major impact on the international.

If two-fund separation holds share turnover must be. What Is Volume of Trade. Two-fund separation theorems suggest a natural definition for trading activity.

The current account gap in the US widened to 2148 billion or 37 of the GDP in the third quarter of 2021 from an upwardly revised 1983 billion in the prior period and compared to forecasts of a 205 billion shortfall.

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Volume_Rate_Of_Change_To_Confirm_Trends_Jun_2020-01-6e5890ced620432597c75fa7ceb59fac.jpg)

Using Volume Rate Of Change To Confirm Trends

What Is The Real Trend In Volumes Nasdaq

/dotdash_Final_Gauging_Support_and_Resistance_With_Price_by_Volume_Jun_2020-01-4224b2d388044d6a8f3fb3d618038a1e.jpg)

Gauging Support And Resistance With Price By Volume

:max_bytes(150000):strip_icc()/dotdash_INV-final-Use-Market-Volume-Data-to-Determine-a-Bottom-May-2021-01-963caf1cc4ac41bf8e3271f6ada9dc1f.jpg)

Use Market Volume Data To Determine A Bottom

:max_bytes(150000):strip_icc()/dotdash_INV-final-Accumulation-Distribution-Indicator-A-D-Apr-2021-01-b3e86084a45649438b410115afe16139.jpg)

Accumulation Distribution Indicator A D Definition

/dotdash_INV-final-Use-Market-Volume-Data-to-Determine-a-Bottom-May-2021-01-963caf1cc4ac41bf8e3271f6ada9dc1f.jpg)

Use Market Volume Data To Determine A Bottom

:max_bytes(150000):strip_icc()/dotdash_INV_final_Sideways_Market_Sideways_Drift_Jan_2021-01-ae5a330a3cea4ff2801f1d6ab69eb7b7.jpg)

Sideways Market Sideways Drift Definition

/dotdash_Final_After_Hours_Trading_Oct_2020-01-e1708defac9e432eb6179f9c74d318a6.jpg)

After Hours Trading Definition

:max_bytes(150000):strip_icc()/dotdash_INV-final-Use-Market-Volume-Data-to-Determine-a-Bottom-May-2021-02-252151586b444f0cb6f7af360a46d187.jpg)

Use Market Volume Data To Determine A Bottom

:max_bytes(150000):strip_icc()/dotdash_INV-Cumulative-Volume-Index-CVI-Apr-2021-012-4d574845ff7b4451b88df2fa1d90d200.jpg)

Cumulative Volume Index Cvi Definition

:max_bytes(150000):strip_icc()/dotdash_Final_LowVolume_Pullback_Definition_Jun_2020-01-e70fea9e10fb419e8cb21de8f9830fc0.jpg)

Low Volume Pullback Definition

Volume Of Trade Definition Examples Calculations

Volume Of Trade Definition Examples Calculations

/dotdash_Final_Extended_Trading_Nov_2020-01-58b7800025324f1c913b7ee962de5bfe.jpg)

Extended Trading Definition And Hours

:max_bytes(150000):strip_icc()/dotdash_INV_final_Uptrend_Jan_2021-01-acc6ad4a4ea04a079698b3518d5831b4.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV_Final_Trading_Range_Jan_2021-01-f3d7acd5074f4a46bfac0be75ce9362f.jpg)

/dotdash_Final_Blow-Off_Top_Dec_2020-01-79b7b9ca1aaa41a98d75d06aa76d947f.jpg)

/Range1-418f9100c8ac4e23a25ab7b6bd234737-8e71b09ea9d94ef69e50778b61420f06.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV_final-TNet-Volume_Feb_2021-01-2215cbe0da3a4bf6aca22cdce578cfdb.jpg)

Post a Comment for "Trade Volume Economics Definition"